The estimated value of each of your customers can play an integral role when making crucial decisions, like whether it’s worth investing more in customer acquisition or retention. That’s why you need to understand the importance of metrics that drive long-term business success. One such metric is CLV. But, what is customer lifetime value (CLV), and how can you calculate this measurement?

In the following, we’ll discuss everything you need to know about customer lifetime value and its importance. Discover what factors influence CLV while we share some useful tips and strategies for increasing these numbers!

Understanding Customer Lifetime Value

Understanding customer lifetime value (CLV) is key to unlocking your business’s true potential. It’s one of the key stats to track as part of your marketing and business strategy.

CLV is essentially a measurement of how valuable a customer is to your company. This value takes into account all the potential transactions they’d make over the span of their relationship with you and calculates the total revenue from that particular customer.

You can look at this in two different ways — historic customer lifetime value (how much revenue each existing customer has already brought to your brand) and predictive customer lifetime value (how much revenue customers could bring to your brand). Both metrics are crucial for tracking success.

Additionally, several key factors have been identified that contribute to CLV. These include:

- Purchase frequency — how often customers come back to purchase your brand

- Average order value — the average amount a customer spends each time they buy from you

- Customer retention — how long can you keep a customer coming back

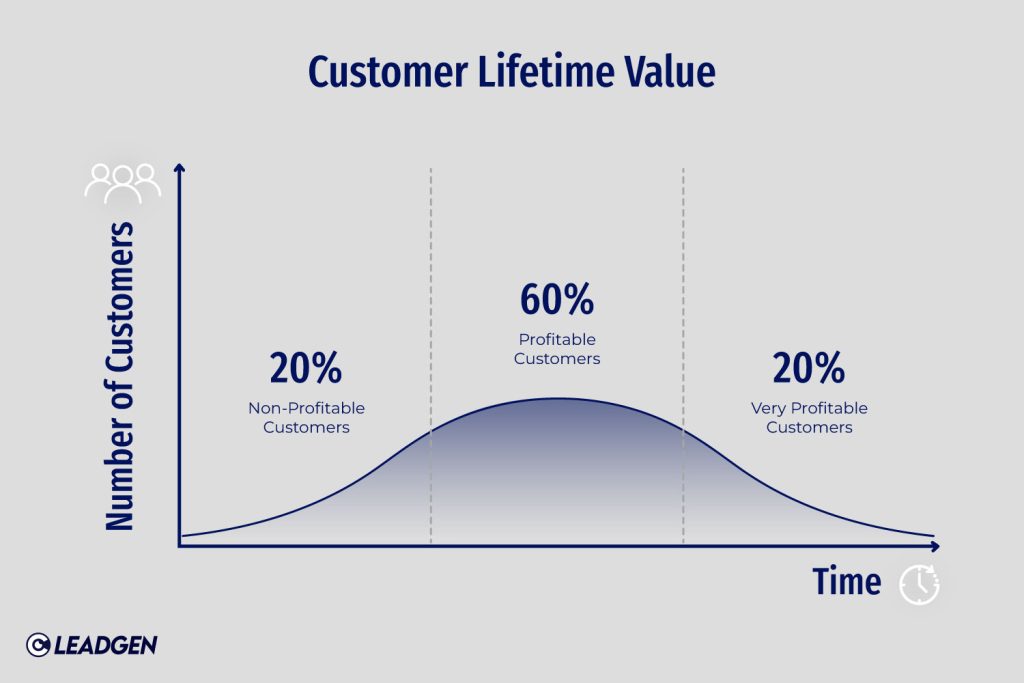

Comprehending these factors, you can understand why some customers are more valuable than others. The more they buy, the higher they spend, and the longer they stay – the more valuable they are to your business.

Importance of Customer Lifetime Value

Understanding what is customer lifetime value in marketing and focusing on it is critical for your business’s long-term success. First, prioritizing these metrics can help you make informed decisions about where to allocate your resources. Instead of spending your entire budget to acquire new customers and short-term transactions, you can invest in strategies that keep your existing, loyal customers coming back.

Moreover, high CLV boosts brand loyalty and satisfaction over time. When you invest in understanding CLV, you’re showing your customers that you care about their experience. Happy customers are more likely to become repeat buyers, maximizing your total revenue and supporting strategic growth.

Essentially, by having satisfied, loyal customers who keep coming back to you, you can ensure that your business is going to thrive in the years to come.

Factors Influencing Customer Lifetime Value

Understanding the factors influencing customer lifetime value is key to achieving success. Once you grasp what drives CLV, you can make smarter decisions that boost profitability and encourage long-term relationships. Here are the crucial elements that impact CLV:

Customer acquisition cost (CAC)

For your business to remain profitable in the long term, you need to ensure that the cost of acquiring a new customer (CAC) is lower than the value that customer brings to your business over their lifetime (CLV). In other words, the value (revenue) generated by a customer (CLV) should be higher than the cost incurred to attract that customer (CAC). By minimizing CAC and maximizing CLV, your business will see higher profits and greater sustainability.

Customer retention and loyalty

Customer retention plays a vital role in maximizing CLV. Having high retention rates boosts CLV, as loyal customers tend to spend more and purchase more frequently.

Average order value

A higher average order value (AOV) has a direct impact on higher CLV. It shows how much a customer spends on average. Implementing sales strategies, like cross-selling or upselling, can significantly increase this number, thus improving overall customer lifetime value.

Calculating Customer Lifetime Value

Let’s break down the process of calculating customer lifetime value.

To start, think of CLV as a simple equation. It helps you understand the value of a customer to your business over time. The basic formula is:

CLV = average order value × purchase frequency × customer retention

First, the average order value refers to the amount a customer spends each time they make a purchase. Next, the purchase frequency indicates how often a customer buys from you in a given time frame, most commonly in years. Finally, the average customer retention represents how long a customer buys from your business.

For example, let’s say your average customer spends $100 for each purchase, buys 2 products from you per year, and remains a customer for 10 years. The formula for this would be:

$100 × 2 × 10 = $2,000

This means your CLV is worth $2,000 over its relationship with your business. But why is it important to calculate CLV?

Calculating CLV gives you a holistic view of each customer’s history with your company. It pinpoints those most likely to buy from you again, giving you a clear picture of where to allocate your resources while being profitable.

Strategies for Increasing Customer Lifetime Value

Boosting your customer lifetime value requires significant time and resources. However, with the right approach, you can achieve sustainable growth and enhance profitability, positively impacting your overall financial health. Let’s now evaluate the best strategies to increase CLV.

Keep your customers happy

The first step should always be keeping your customers happy. It’s the simplest and most effective CLV boost that encompasses improving customer service and promptly addressing common concerns and pain points they have.

By handling these customer inquiries as soon as possible, you demonstrate strong dedication to meeting your customers needs and demands.

Loyalty programs

Demonstrating that you value your customers is key to retaining them. One effective strategy is implementing loyalty programs to enhance customer retention. These programs reward loyal customers by allowing them to earn points, which can be redeemed for future purchases, discounts, or coupons. It’s crucial for customers to understand that their spending directly translates to earning more points or discounts.

Upselling and cross-selling

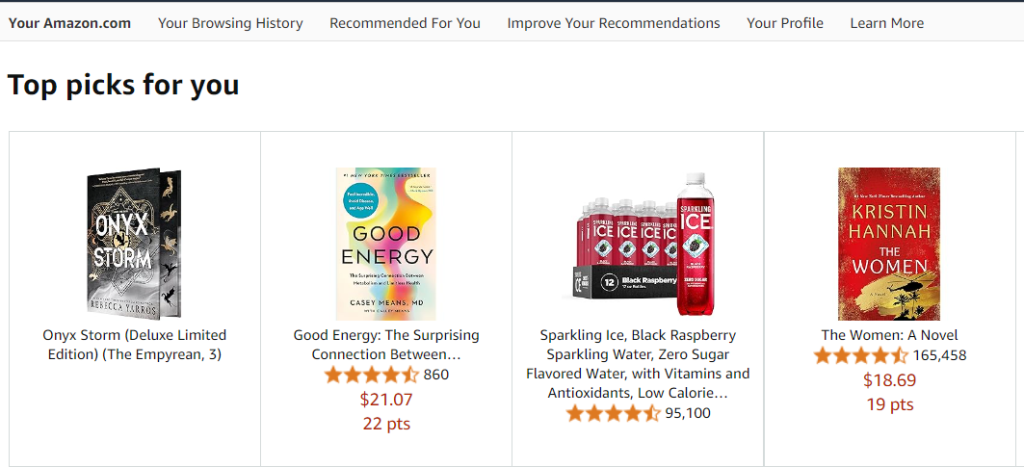

To increase your CLV, you need to encourage customers to purchase higher-value items or additional products. As we’ve mentioned, this can be easily achievable through cross-selling and upselling.

When customers understand the enhanced features and benefits that justify the higher price, the choice between high-value and low-value products becomes clearer. As a result, higher-priced products appear more appealing to your customers.

Personalize marketing

Personalization is key nowadays. Customers are more likely to develop close, lasting relationships with a brand that makes them feel appreciated.

Tailor your marketing efforts to individual customer preferences, needs, and behaviors to boost engagement and spending. By fostering these relationships through regular, meaningful interactions across multiple channels, you not only increase customer loyalty but also enhance their lifetime value. This impacts CLV and drives long-term profitability for your business.

Conclusion

In conclusion, customer lifetime value (CLV) is a pivotal metric for driving long-term business profitability and success. It helps you determine customers’ value to your business by predicting how much they may spend on your services or products over time.

By understanding what is customer lifetime value and optimizing it, you can make strategic planning regarding customer relationships, new acquisitions, and marketing and sales decisions. This ensures you have the necessary data-driven insights to take the right approach and reach maximum profitability and business growth.

Boosting customer lifetime value can be daunting, particularly if you’re struggling to generate high-quality leads. At CLICKVISION Lead Gen, we’re dedicated to connecting you with high-potential leads who are actively seeking solutions that align with your business. Contact us today to learn how we can help you enhance each customer’s lifetime value and drive your success!

Dimitar is a seasoned marketing specialist and the visionary behind CLICKVISION. With over 10 years in digital marketing, he excels in crafting marketing strategies that boost rankings, which in return increase leads, conversions, sales, profits, and ROI.